How to check if your calculated EMI is correct or not?

Are you planning to get a personal loan for your dreams or pressing needs? Well, you don’t have to worry! Today unlike in the past, the Personal loan application is much faster, easier and more convenient. You can actually have the loan amount disbursed into your account in less than 24 hours.

That said!

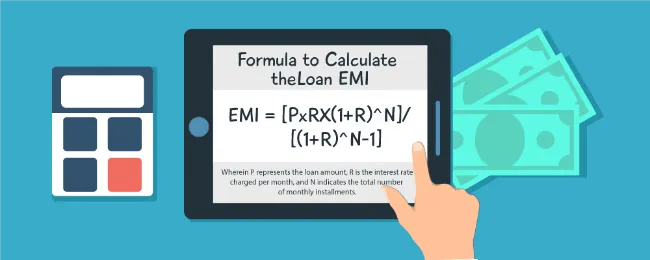

Before you proceed, it’s crucial to ensure that your monthly instalment, also known as Equated Monthly Installment (EMI), is accurately calculated. That will help you avoid any financial troubles in the future.

In this article, we’ll explore easy methods to check the accuracy of your EMI calculation. We’ll cover the Flat Rate, the Reducing Balance Interest, using an Excel Spreadsheet and a personal EMI calculator method.

What is EMI, and Why is it Important?

EMI is like a monthly savings plan to repay your loan. It includes the principal amount you borrowed and the interest the lender charges.

By paying the EMI regularly, you gradually repay the loan over time. Accurately calculating your EMI is crucial because it helps you plan your budget and ensures you don’t miss any payments.

Methods to Check Your EMI Calculation

- The Flat Rate Method:

The flat rate method is a simple way to calculate EMIs, but it might not always give the most accurate results. By using this method, the interest is calculated on the entire personal loan amount throughout the loan period. Let’s see how you can check your EMI using this method:

For example:

Loan Amount: Rs10,000

Loan Tenure: 24 months

Interest Rate: 12% per annum

EMI Calculation:

Interest Payable per Year = Loan Amount × Interest Rate = Rs10,000 × 0.12 = Rs1,200

Total Interest Payable = Interest Payable per Year × Loan Tenure = Rs1,200 × 2 = Rs2,400

Total Repayment Amount = Loan Amount + Total Interest Payable = Rs10,000 + Rs2,400 = Rs12,400

EMI = Total Repayment Amount / Loan Tenure = Rs12,400 / 24 ≈ Rs516.67 per month

However, the flat rate method may not give you the most precise results because it doesn’t account for the reducing loan balance over time.

- The Reducing Balance Interest Method:

The reducing balance interest method is widely used by financial institutions because it gives more accurate results. The interest is calculated on the outstanding loan amount after each monthly payment.

This approach results in lower interest payments over time. To check your EMI using this method, use an EMI formula calculator or ask your lender for assistance.

- Using an Excel Spreadsheet:

If you prefer a manual approach, using Microsoft Excel or any spreadsheet software to check your EMI accuracy would be ideal.

Create a table with columns for Month, Opening Balance, EMI, Interest Payable, Principal Repayment, and Closing Balance.

Input the loan details in the table and use the correct formulas to calculate interest and principal repayments for each month. You can then cross-check the results with a personal EMI calculator online to verify their accuracy.

- Utilizing a Personal EMI Calculator:

If you are looking for the easiest and most precise method, a Personal EMI calculator is your best option. You can find user-friendly calculators on various financial websites and mobile apps.

Enter your loan amount, interest rate, and tenure, and the calculator will instantly show you the correct EMI. Some calculators even include processing fees and other charges, thus giving you a more accurate amount of your monthly payment.

Using a personal EMI calculator has several benefits:

It’s fast: The calculation is instant, saving you more time and effort.

It’s accurate: There is less chance of errors since the calculator does all the work.

It’s flexible: You can experiment with different loan amounts, tenures, and interest rates.

It helps with planning: You can plan your monthly budget better knowing the EMI amount.

Conclusion

Before taking a personal loan, it’s crucial to calculate your monthly instalment (EMI) correctly. While the flat rate method is simple, it may not be the most accurate.

The reducing balance interest method is commonly used and gives better results. If you prefer manual calculations, you can use an Excel spreadsheet, but you must be careful.

If you’re looking for the most precise and easy way, please use a personal EMI calculator available online or on apps. It will help you make well-informed decisions and manage your budget effectively, ensuring a smooth financial journey in the future.

Also Read: Tips To Fulfill Documentation Criteria For Personal Loan